What are Rent and Rental Income? What is Considered Rental Expenses? Can We Use Rental Income for Personal use?

Rental Income Rental

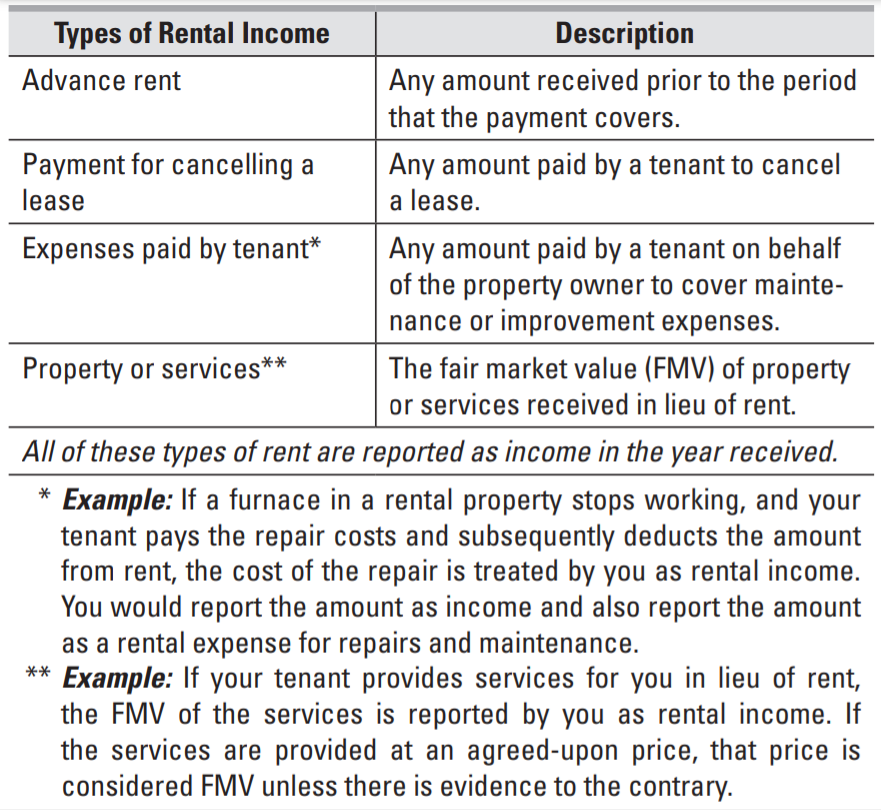

income includes any payment received for the use or occupancy of the property. In addition to normal rent payments, the following items are reported as rental income.

Security Deposits

A security deposit is not included in rental income when received if you plan to return it to the tenant at the end of the lease. If any amount is kept during the year because the tenant did not live up to the terms of the lease, include that amount as rental income. If an amount called a security deposit is to be used as a final payment of rent, it is advance rent and is included as income in the year received.

Note: Individual states have laws requiring payment of interest by property owners who hold security deposits.

Rental Expenses

A deductible expense is an expense that is both:

- Ordinary. Common and accepted in your line of work, and

- Necessary. Helpful and appropriate for work.

An expense need not be required in order to be considered necessary. Facts and circumstances must be considered in each case to determine whether an expense is ordinary and necessary.

Depreciation

Depreciation deductions begin when the property is ready and available for rent.

Vacant Property

Expenses are deductible beginning at the time the property is available for rent regardless of when rental income is actually received.

Insurance Premiums Paid in Advance

Insurance premiums paid more than 12 months in advance are deducted in the year to which the policy applies. Premiums paid for 12 months or less are deductible in the year paid.

Local Transportation Expenses

Local transportation expenses incurred to collect rental income or to manage, conserve, or maintain the rental property are deductible. You may deduct either actual expenses or the standard mileage rate for an auto (56.0¢ per mile for 2021).

Commuting

IRS regulations for investment expenses specifically mention commuting expenses as being nondeductible, making the same commuting rules that apply to business expenses also apply to passive rental activities.

Travel Expenses

Expenses for traveling away from homes, such as transportation and lodging, are deductible if the primary purpose of the trip is to manage, collect rental income, conserve, or maintain the rental property.

Interest

Prepaid interest is not deducted when paid. Instead, prepaid interest is deducted in the period to which it applies. Points or loan origination fees paid for a rental property are deducted over the life of the loan.

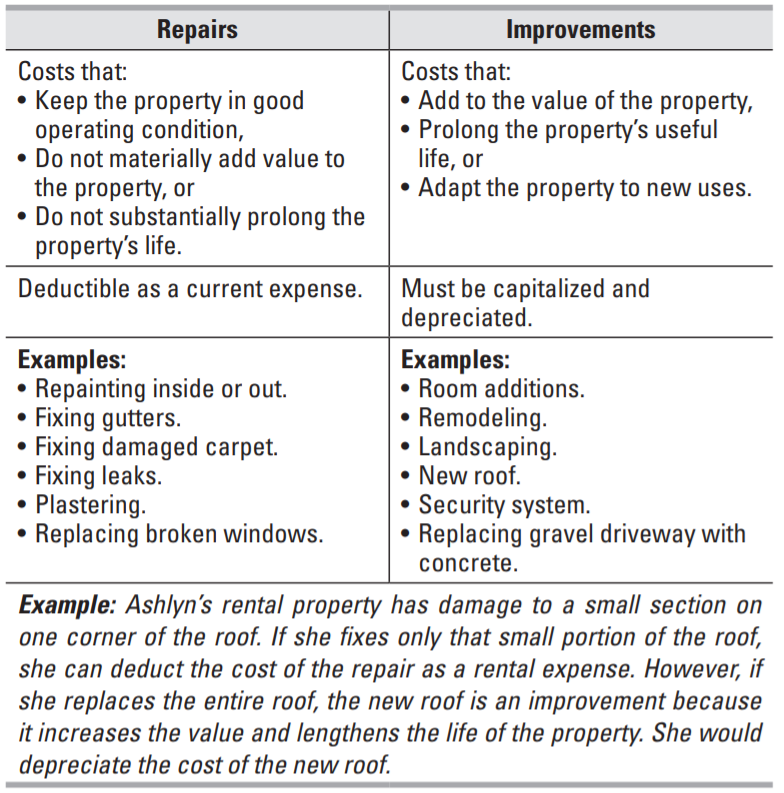

Repairs and Improvements

The cost of repairs to a rental property may be deducted as a current expense. The cost of improvements must be recovered by taking depreciation. Whether an expenditure qualifies as a currently deductible repair or is required to be capitalized, is a factual determination. You bear the burden of proof and must have sufficient records to substantiate the expense as a deduction instead of capital expenditure.

Personal Use of Rental Property— Roommates and Boarders

Renting Part of Property

If a portion of the property is rented out, and a portion is used for personal purposes, any reasonable method of allocating expenses between personal and rental use is allowed. For example, dividing the cost of utilities by the number of people living in the home, or dividing expenses based on the square footage of use, are reasonable methods.

Example: Phil owns and lives in a personal residence that has 1,800 square feet of floor space. Phil takes in a border and rents out a room that is 12 × 15 feet, or 180 square feet. Phil can allocate 10% of the home’s expenses to the rental. The total utility bills for the year are $2,700. Phil can deduct $270 ($2,700 × 10%) from rental income.

Phone Expense

The cost of the first phone line into a home that is used for both personal and rental purposes is not deductible.

Direct Rental Expenses

A full deduction is allowed for expenses that belong only to the rental part of the property. Examples of fully deductible rental expenses include painting a room that is rented out, additional liability insurance attributable to the rental, and the cost of a second phone line that is strictly for the tenant.