What Classifies a Home as a Rental Property? Can I Personally use my Rental Property? What is Considered a Substantial Service for Rental Property?

Short-Term Rentals

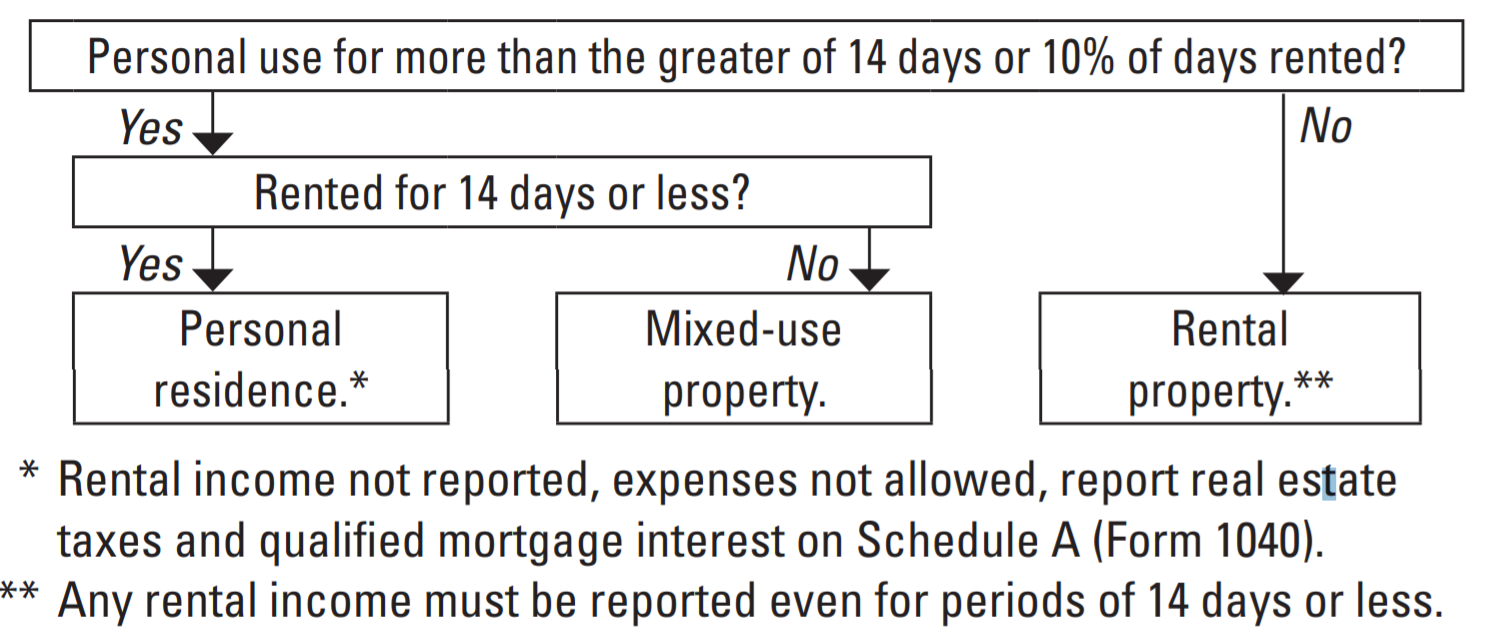

Income and expenses related to rental of your home, a room in your home, or a vacation home, must be reported on your tax return. Expenses may need to be divided between rental and personal use. Limits apply when deducting rental expenses for a home that is also used for personal purposes.

If you rent out part of your home for 14 days or less, the rental income may be tax free. See Tax-Free Rental Use—14 Days or Less, later.

Rental Property Also Used as Home

If property is used for both personal and rental purposes, all rental income must generally be reported on your tax return. However, expenses must be allocated between personal and rental use.

If rental expenses exceed rental income, the ability to deduct a loss on your tax return depends on whether the property met the definition of a “home” for tax purposes. If the property was used as a home, the property is considered to be “mixed-use property,” and the deduction for indirect expenses like insurance and utilities is limited to rental income. Disallowed expenses are carried over to the next tax year, and the limit still applies even if you did not use the property as a home for that year. If the property had minimal personal use and is considered rental property, an excess of expenses compared with income can generate a loss on your tax return.

You use a property as a home during the year if you use it for personal purposes more than the greater of:

- 14 days, or

- 10% of the total days it is rented to others at fair rental value.

Example: Andrea has a vacation cabin that she used for personal purposes for 17 days and rented out for 160 days during the year. The cabin is considered to be used as a home because she used it for personal purposes more than 14 days. This means the cabin is considered mixed-use property, and Andrea’s deduction for expenses is limited to rental income. If Andrea had used the property personally for 14 days or less, the cabin would be considered rental property (not mixed-use) and she would be able to deduct a loss if rental expenses exceeded rental income.

Note: Although all rental income must generally be reported on the tax return, expenses must be allocated between personal use and rental regardless of whether the property is considered mixed-use or rental property.

Personal use. Personal use of a dwelling includes not only use by your family or other owners, it also includes use by anyone who pays less than fair rental value for use of the property.

Example: Emma and her neighbor are co-owners of a condominium. Last year, Emma rented the unit to vacationers for 156 days. Emma’s neighbor used the unit for 14 days during the year, and Emma did not use it at all. Because Emma’s neighbor is an owner of the property, the neighbor’s use is considered to be personal use, and expenses must be allocated accordingly. Because the property was not used for personal purposes more than 14 days or 10% of the number of days it was rented at fair rental value, the property is not considered mixed-use, and a loss can be reported on the tax return if rental expenses exceed rental income.

How to Classify Rental Property for Tax Treatment

Loss allowed. For mixed-use property, the rental portion of mortgage interest, real estate taxes, and other direct rental expenses such as advertising are allowed in full and can create a deductible loss.

Tax-Free Rental Use—14 Days or Less

If you use property as a home and rent it out for 14 days or less during the year, you are not required to report the rental income and expenses. Expenses such as mortgage interest and real estate taxes that are allowable as itemized deductions on your tax return are still deductible.

Example: A major golf tournament comes to town and Mark rents his home out for the six-day duration of the tournament. He does not rent out his home for any other time during the year. The rent he receives for the six-day period is tax-free to Mark and is not required to be reported on his tax return.

Providing Substantial Services

If you provide substantial services to renters such as cleaning, changing linens, housekeeping service, guest tours, or meals and entertainment, the rental activity is considered a business and the net income is subject to self-employment taxes in addition to income tax. Substantial services do not include providing heat and light, internet, cleaning of common areas, or trash collection.

For example, if you rent a room in your home and provide breakfast or other meals for your tenant, you may be providing substantial services. Discuss this with your tax advisor for more information.

Renting Part of Personal-Use Property

If you have a portion of personal-use property (including a vacation home) that you rent out, you must divide your expenses between rental use and personal use, as though you had two separate pieces of property. You can deduct the expenses related to the part of the property used for rental purposes, such as home mortgage interest, and real estate taxes, as rental expenses. You can also deduct the rental portion of some expenses that would otherwise be nondeductible personal expenses, such as expenses for electricity or painting the outside of the house. For expenses directly related to the rental, such as painting a room that you rent out or paying liability insurance directly related to renting out a room, the entire cost of the direct expense is deductible. See your tax advisor for information about deducting depreciation on your rental property and any furniture used in the rental activity.

Example: Julie lists her spare bedroom on a popular short-term rental website. The spare room is 300 square feet and her whole house is 1,500 square feet. She has the following expenses this year

Repainting the spare room ............................................................ $300

Replacing the broken door in the spare room ............................ $150

Real estate taxes and mortgage interest....................................$6,500

Internet, electricity, gas, water...................................................$2,650

Expenses for painting and replacing the door in the spare room are direct rental expenses and are fully deductible.

Expenses of $9,150 for real estate tax, mortgage interest, and utilities are not strictly for the rental portion of Julie’s house and must be prorated. Prorating by square footage is a common method, which would be 20% (300/1,500). $1,830 ($9,150 × 20%) of the expenses for the entire house are deductible as rental expenses. Julie can deduct the remaining real estate taxes and mortgage interest as itemized deductions on Schedule A (Form 1040). The remaining expenses for utilities are considered personal expenses and are not deductible.