What Are the Limitations to Deduct Prepaid Farm Supplies? How to Calculate Real Estate Taxes on Farm Land? What Are Conservation Expenses?

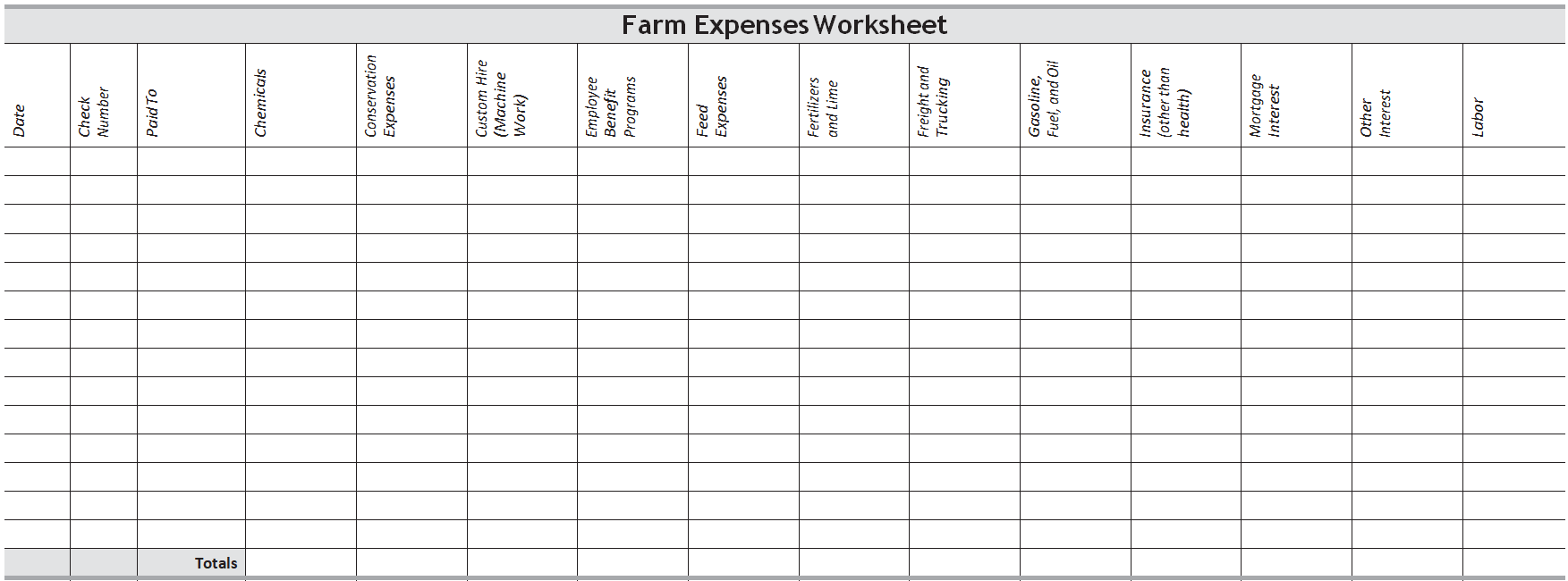

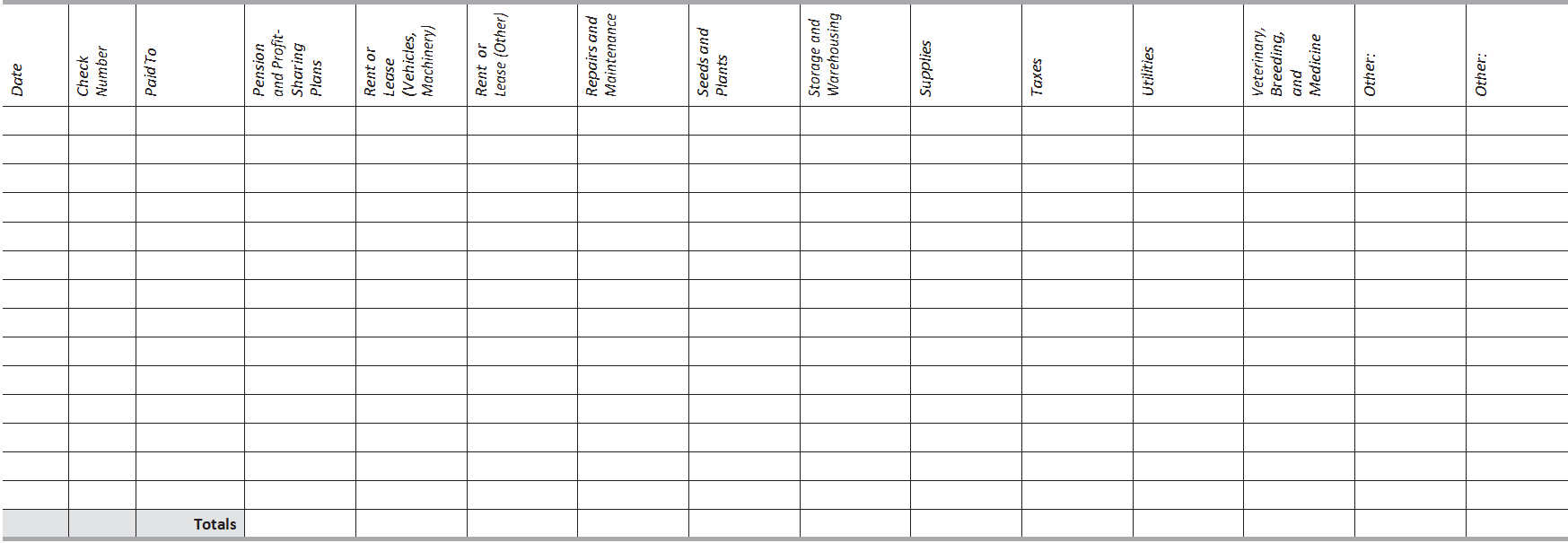

Farm Expenses Worksheet

Prepaid Farm Supplies

Prepaid farm supplies include feed, seed, fertilizer, and similar farm supplies that are not used or consumed as of the end of the tax year. A deduction for prepaid farm supplies may be limited to 50% of the total other deductible farm expenses for the year.

Real Estate Taxes on Farm Land

Taxes on the portion of the farm used as the taxpayer’s personal residence should be deducted as itemized deductions rather than as business deductions.

Soil and Water

Conservation Expenses

A farmer can choose to deduct certain expenses for soil or water conservation or for the prevention of erosion of land used in farming. Otherwise, these expenses are capital expenses added to the basis of the land. The deduction is limited to 25% of gross income from farming. Excess amounts are carried forward.